BUSINESS CREDIT & FUNDING PLATFORM

BUSINESS CREDIBILITY

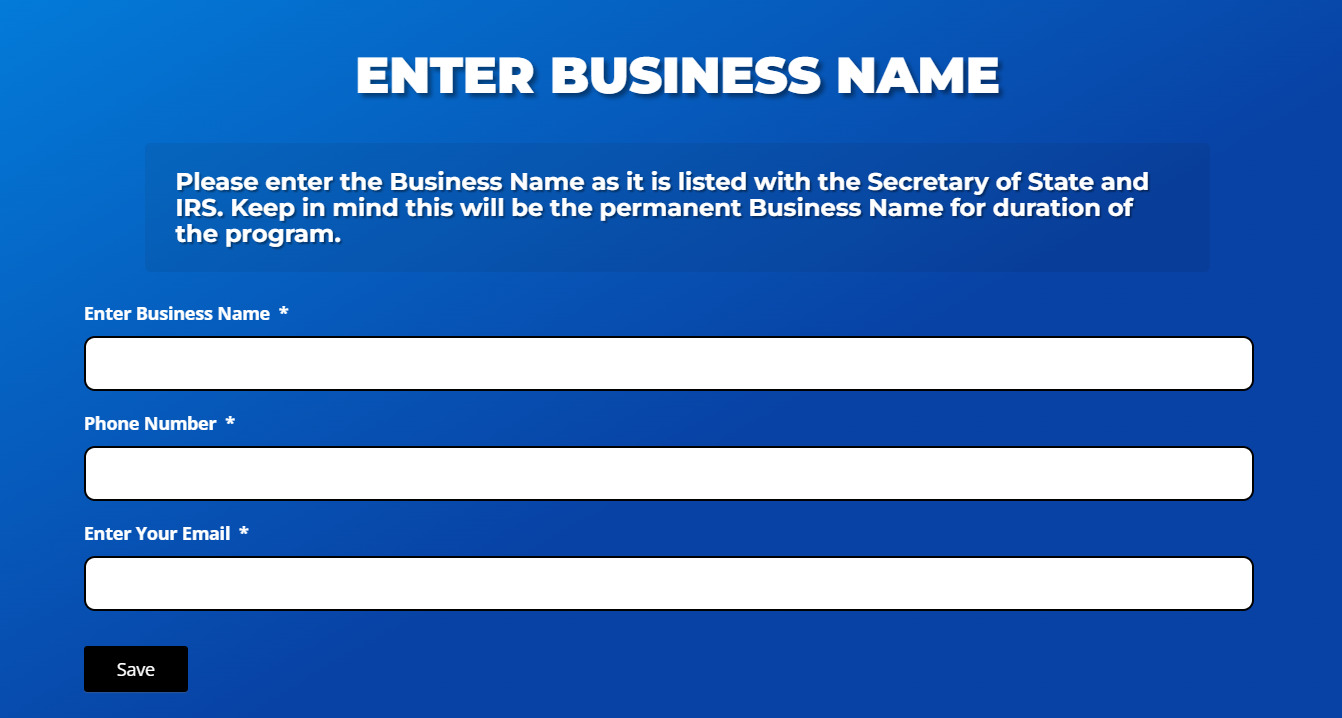

STEP 1.1 – BUSINESS NAME

PROGRAM MENU

➡ MODULE 1 - BUSINESS CREDIBILITY

• Step 1.1 Business Name

• Step 1.2 Business Address

• Step 1.3 Business Entity

• Step 1.4 EIN#

• Step 1.5 Business Phone # & 411

• Step 1.6 Business Website & Email

• Step 1.7 Business Licence

• Step 1.8 Business Bank Account

• Step 1.9 Business Merchant Account

• Step 1.10 Wrap Up

➡ MODULE 2 – ESTABLISH BUSINESS REPORT

• Step 2.1 Dun & Bradstreet

• Step 2.2 Experian Business

• Step 2.3 Equifax Business

• Step 2.4 Reporting- How to Fix Business Credit

➡ MODULE 3 – START BUILDING: TIER 1

• Step 3.1 Start Building: Tier 1

➡ MODULE 4 – BUSINESS REPORT MONITORING

• Step 4.1 Credit Monitoring

• Step 4.2 Monitor Dun & Bradstreet

• Step 4.3 Monitor Experian Business

• Step 4.4 Monitor Equifax Business

• Step 4.5 Request Lexis Nexis report

• Step 4.6 Request Chex Systems Report

➡ MODULE 5- BUILDING CREDIT: TIER2

• Step 5.1 Building Credit: Tier2

➡ MODULE 6 – ADVANCED BUILDING: TIER 3

• Step 6.1 Advanced Building: Tier 3

DO YOU HAVE A BUSINESS NAME?

SELECT A BUSINESS NAME

There is a lot that goes into a name! Make sure your business name can be trademarked, doesn’t include any high-risk industries and can be or is filed with the state before you build your business further.

RESOURCES

We hope you love the products and services we recommend! We research and update these on a regular basis. Just so you know, we may receive a commission from links on this page. We are diligent to ensure any compensation we receive does not affect the price or level of service offered to you.

COST: Varies

THE CONTENT OF THIS RESOURCES SECTION IS RESTRICTED.

PLEASE SIGN UP TO GET ACCESS!!

VIEW VIDEO 1 TRANSCRIPT

It seems simple to select a business name but what do you need to know when selecting a business name?

Pick a business name that you can trademark and doesn’t include verbiage that puts your business in a high-risk industry.

Before you purchase your domain, build a website or print business cards make sure the name you select is available with your secretary of state.

Once you know that your business name is available, reserve your business name and file your business entity.

As you can see there is a lot that goes into selecting your business name.

VIEW VIDEO 2 TRANSCRIPT

This segment reviews how to maintain or establish your business credibility.

What is credibility? The quality of being trusted and believed in.

You can boost your business’s credibility and control the perception lenders, competitors, prospects, and other entities.

Anyone can pull your business credit. It is unlike personal credit where a signed authorization needs to take place.

When someone pulls your business credit they can view many intimate details about your business.

When you set up your business entity, EIN#, Business address, email, website, phone number & business credit reports you will keep in mind that these details boost your business credibility.

Let’s start with your business entity… It’s all in the name.

When you establish your business entity with the secretary of state make sure you select a name that you can use on all of your business records. If your business name defines the product or service your company offers it should be inclusive.

For instance, if you are selling sporting goods you wouldn’t want to name your business Nate’s Bats.

There are some high-risk industries that may guarantee a decline with creditors. Using that high-risk industry description in your business name will limit your financing options.

You can review the segment notes for a list of these commonly restricted industries.

When setting up your business entity you will likely ask yourself what type of entity you should establish. Each entity has their own tax and liability differences.

Your segment notes will give you a grid to help you make your decision.

Federal EIN#

Once you have established your business entity you can now apply for your federal EIN#. Your federal EIN# is your business’s specific identification number. Just like your SSN # is your individual identification number.

You will use the same business information you used to establish your business entity. It’s important that you use the same business name, address and contact information used on all business records. The slightest variance can result in declines or incorrect reporting.

It is simple to apply for your federal EIN# on the IRS website.

The system will ask for the business owners information & SSN.

See the course notes for helpful links.

Business Address

Many lenders and prospects prefer that a business has an actual physical business location. Some lenders, specifically revenue based lenders, may decline if your business doesn’t have an actual physical business location.

It is important that your business uses an address that is listed with the United States postal service. Many lenders use USPS tools to verify business locations. Refrain from using a business address that others businesses are using. When business credit is reported sharing addresses can result in misreporting payment data.

Business Phone number

Lenders are able to see if your business phone number is a cell phone, residential number or an actual business phone number. It boosts credibility to have an actual business phone number. We recommend that you list your business phone number under the national 411 directory so that lenders can more easily verify your business.

Website & Email

Lenders and prospect customers will likely search for your website. A valid and operational website can boost credibility drastically.

Equally important is a business email address instead of using a free or personal email address.

For instance john@atctechnologies.com instead of johntechnologies@gmail.com

There are many inexpensive options to achieve these goals. We have helpful resources in your segment notes.

Business Credit Reports

It is important when establishing your business credit reports that you keep in mind they can boost your business credibility.

Business credit reports that appropriately reflect who your business is and how the business handles credit will ease the minds of those that are interested in working with your business. Business financing can be declined based on business credit reports alone.

Who will verify your business’s credibility?

- Trade accounts

- Lenders

- Suppliers & manufacturers

- Clients

- Prospects

- And more

It’s time to take control of your business credibility.

search secretary of state records for business name

FINANCE RESTRICTED INDUSTRIES

Restricted Industries list pertains mainly when obtaining financing

Restricted industries (automatic decline) include:

• Ammunition or Weapons Manufacturing; wholesale and retail

• Bail Bonds

• Check Cashing Agencies

• Energy, oil trading, or petroleum extraction or production

• Finance: (Federal Reserve Banks, foreign banks, banks, bank holding companies,

loan brokers, commodity brokers, security brokers, mortgage brokers, mortgage bankers,

mortgage companies, bail bond companies, or mutual fund managers)

• Gaming or Gambling Activities

• Loans for the speculative purchases of securities or goods

• Pawn shops

• Political campaigns, candidates, or committees

• Public administration (e.g., city, county, state, and federal governmental agencies)

• X-rated products or entertainment

High-Risk Industries (subject to stricter underwriting guidelines):

• Agriculture or forest products

• Auto, recreational vehicle or boat sales

• Courier services

• Computer and software related services

• Dry cleaners

• Entertainment (adult entertainment is to be considered restricted)

• General contractors

• Gasoline stations or convenience stores (also known as c-stores)

• Healthcare; specifically nursing homes, assisted living facilities, and continuing care retirement centers

• Special trade contractors

• Hotels or motels

• Jewelry, precious stones and metals; wholesale and retail

• Limousine services

• Long distance or “over-the-road” trucking

• Mobile or manufactured home sales

• Phone sales and direct selling establishments

• Real estate agents/brokers

• Real estate developers or land subdividers

• Restaurants or drinking establishments

• Software or programming companies

• Taxi cabs (including the purchase of cab medallions) Travel agencies